Title Insurance

You could be wondering why you need to get title insurance. As a matter of fact, most people don’t even know what title insurance is for. They just think that it is something else that they have to pay for when they are buying a house. Title insurance is all about protection! Think about it, intelligent people don’t ever take huge chances on a lot of money just to save a little money.

Do I Need Title Insurance?

Why title insurance?

When you borrow money to purchase a house, the bank is going to protect its interest by making sure that if there is anything wrong with the title to the house, the bank has not lost its interest in the property. Similarly, you need to protect your interest in the property so, should there be an issue, you have the insurance to pay

Real estate can be fairly complicated, affecting the rights of many people who may have a legal claim to a particular piece of property. Forgery, wills, fraud, mental incompetence, marriage and divorce, minors entering into contracts, and mistakes are all possible threats to your title being free and clear of claims.

Since banks are interested in protecting their portion of the property, it is important for you to protect your interest in your property. If you do not do so, you run the risk of potentially losing your house while still having to pay for it, or potentially ruining your credit.

Let me give you an example…

Let’s say that you are going to purchase a home. You look around and find the perfect place. The price for the house is a half a million dollars. You have some cash in your pocket so you plunk down 20% of the selling price, or one hundred thousand dollars. You and your family move in and you are just ecstatic. Friends come over to the house during the house warming party and tell you how beautiful everything looks. You think everything is fine as you settle in to your new house and it begins to feel like a home.

Then something terrible happens…

You hear people opening the front door. They come barging into your home yelling, “What are you doing in my house!” You see…it is their house and they can prove it. “How?” you say. Because, during the summer they went away on vacation for a few months and while they were gone, some con artists broke into the house and took it over. They got some fake identification made up, called up a Realtor and said they would like to sell their house. Trouble is they do sell it…TO YOU!

Your ecstasy turns to tragedy in an instant and now you have got huge problems…

Who is going to pay for the real estate lawyers…you? If only you had taken out that title insurance when you had the opportunity you would be sleeping a lot better right now. Say goodbye to the $100,000.00 and say hello to a whooping note of $400,000.00 that you are still responsible for!

“Come on, does that really happen?” You better believe it does – that and a whole lot more. You would be foolish not to protect yourself from the myriad of things that could and do happen when dealing with such large sums of money. There is an old saying that you have heard many times before – “Buyer beware!” When it comes to buying a house a better saying is “Buyer be protected!”

If you didn’t know before, you certainly should understand now that title insurance is a MUST and is well worth the money you’ll spend. In return for that money you will get a lifetime of protection and peace of mind because as long as you own the property – you are protected and you will be able to sleep well at night knowing that if something does happen – you won’t be the one stuck holding the bag!

Title insurance company, title insurance Florida, foreclosure attorneys fort lauderdale

Who Pays for Title Insurance in Florida?

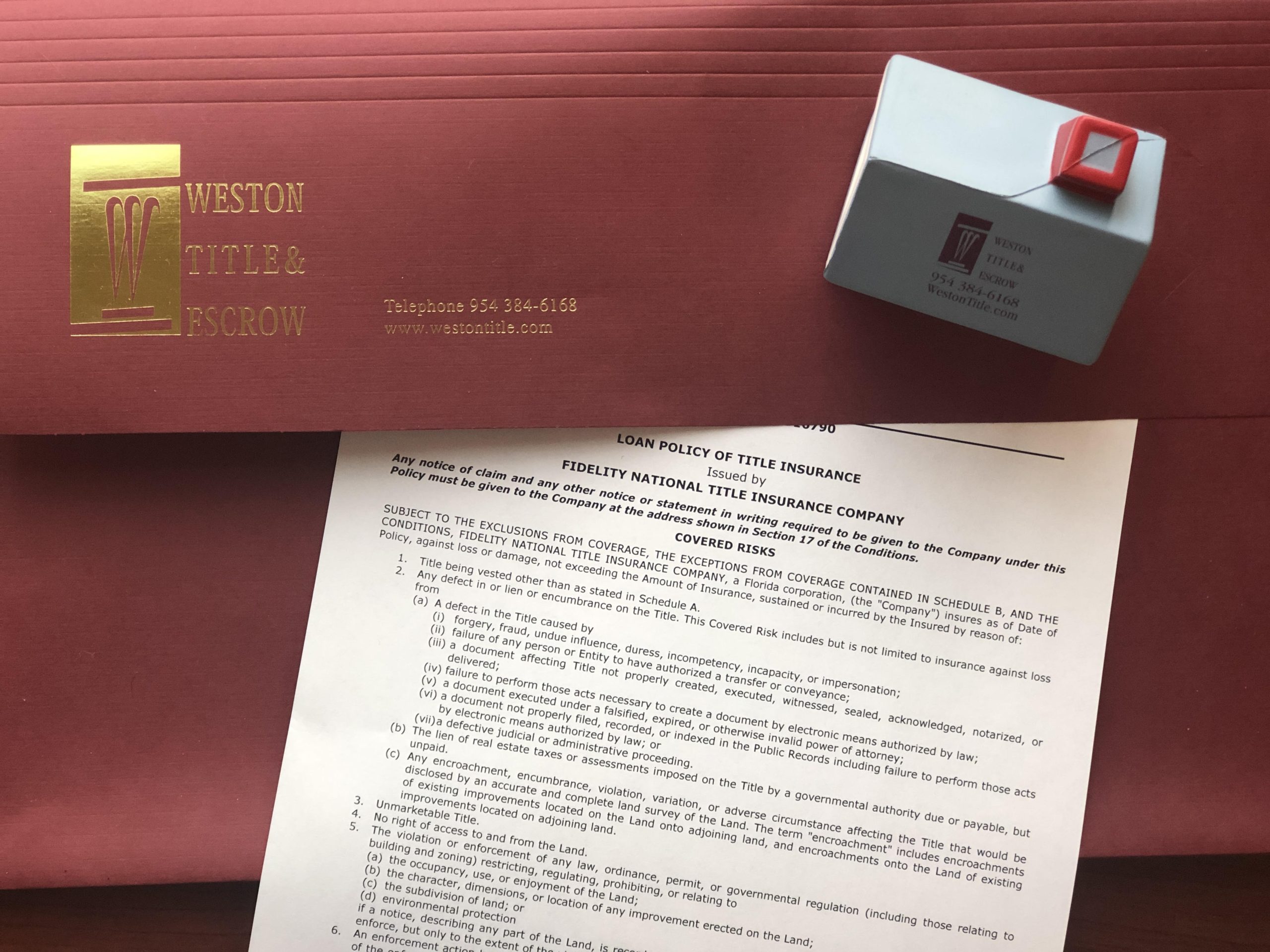

Weston Title is a unique Florida Title Insurance company, attorney owned & Operated offering great Title Insurance rates.

Whether you are buying or selling estate for residential, commercial, or investment purposes, one does not necessarily know who is going to be responsible for the payment of real estate title insurance. It can be only two parties: the buyer or the seller. In very rare circumstances, it can be negotiated in such a way that both parties pay, but that is highly, highly unusual. Typically, what determines who pays for title insurance is the custom in the community or area in which you are buying or selling real estate.

There is no hard and set rule as to who is responsible for the payment of title insurance; rather, it is by convention. In order to make it easier for you, our team at Weston Title is providing you with an entire statewide list for the State of Florida so you will know who pays for title insurance in every county and community in which you may be buying or selling real estate in Florida.

When you are dealing with Weston Title, you only deal with the best of the best in title insurance. For your protection, our multi-billion dollar underwriters are:

- Fidelity National Title Insurance Company

- Attorney’s Title Insurance Fund (The Fund)

Should you need assistance with a real estate purchase or sale, Weston Title & Escrow, Inc. can be reached at 954-384-6168