Title Search

What is a Title Search?

A title search is a comprehensive search of documents, including local records and sources, on a specific property. The title search shows you who may have a claim on the property, as well as any deed restrictions that may limit how the property can be used.

What kinds of liens may affect property?

There are several types of liens that can prevent the conveyance of property unless the liens are settled. Examples include the following:

- Materialman Lien for unpaid contract work: This lien arises when a contractor who has worked on a home or someone who provided materials for the home within the past 90 days and were not paid.

Typically, as long as the debt is completely paid, the lien is thereby satisfied and the title is cleared, allowing for a property sale to occur. Sometimes, if you are unable to pay the debt, an attorney may be able to negotiate the deal so that the lien is paid off the top of the proceeds from the sale of the property. If that is the case, the cost of paying off the lien is part of your closing costs.

- Homeowner Association Lien

Homeowner Associations may file a lien against your property if you have not paid your association fees or if you do not abide by the Association rules.

The easiest way to resolve these types of liens is pay off the lien so that you are then able to move with the sale of your property.

- Department of Revenue Lien: This type of lien usually occurs for failure to pay state taxes. You may need to contact a CPA in order to see if you can move this lien to another property if you are unable to pay off this lien.

- IRS Lien: This lien is from the nonpayment of federal taxes and has a super priority over all other liens. In order to resolve this lien, you either will have to pay off the outstanding debts, use the proceeds of your home to cover the lien should the lien be written into a settlement agreement with the IRS, or try to negotiate the amount of the lien with an attorney.

- Real Property Tax Lien: If you do not pay your local real estate taxes, a lien will be placed on your property.

What is Title to Property mean?

When purchasing a residential or commercial property, the title, or ownership of the property is critical. Title to a property shows the ownership of a property, and therefore who has the right to sell the property. While this may seem obvious, there are issues that may cloud title, or effect the ability of one to convey or sell property.

Liens and other sticky situations

For instance, there may be situations where liens arise which prevent the conveyance of the property until the lien, or debt, is fully paid. A lien is similar to a blemish on a report card, as the lien is a defect that shows up on a title search.

Only the owner of the property can sell the property. If, for example, a husband and wife try to sell their home, but the home is only in the husband’s name. The husband is the only person that can sell the home, not the wife. This is critical, especially if there is a looming divorce or incomplete settlement agreement that does not include the real estate at issue.

When would you need a property title search?

Title searches are mostly performed during the closing process, after the buyer has made an offer on a property and both the buyer and seller have a solid contract.

Other reasons for conducting title searches, include but are not limited to, preparing deeds, conducting due diligence in researching potential investment properties, and bidding on distressed properties.

Who performs a title search?

Weston Title performs title searches as part of our closing procedure. Aside from property closings, should you wish to have a quitclaim prepared, we perform a title search to make sure that the property can be conveyed and that the owner of the property is able to convey the property. Investors interested in distressed properties also need to have a title search prior to moving forward with their investment.

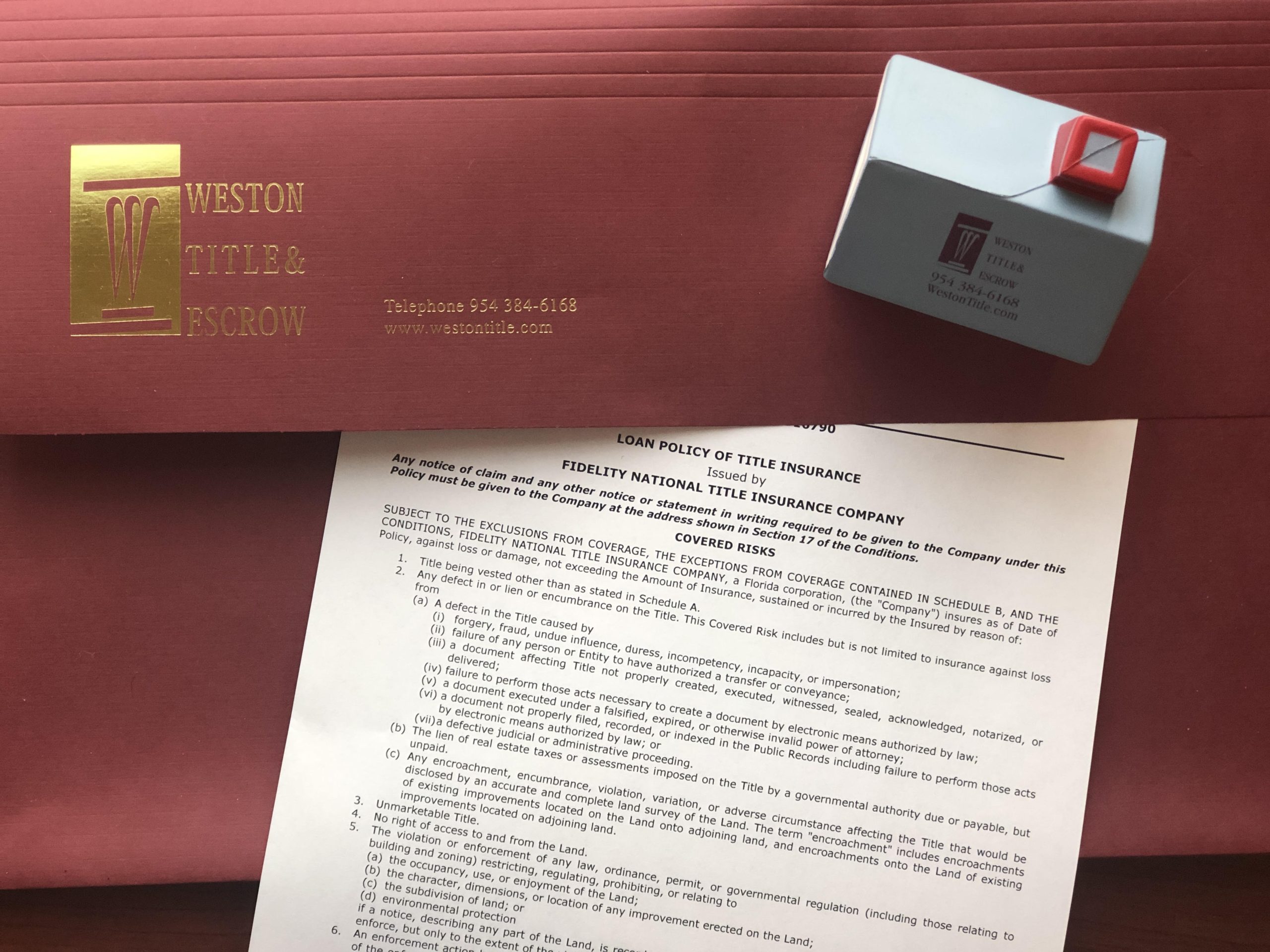

What is title insurance?

Title insurance protects against title issues. If a title company misses something in a search, title insurance protects the buyer and ensures that the owner of the property has insurance to cover the cost of the loss due to the failure of title. Failure of title occurs due to a lien, back taxes, and/or failure to correct a violation—all of which can be avoided by a title search.

Our team at Weston Title provides title insurance as part of the closing process, performing title searches to make sure that the title to the property is clean and conveyable. Should you have any questions or need assistance with your closing, please call us at 954-384-6168.