South Florida Inventory Down, Mini Recovery in Sight for 2012 Economists Say

Sun Dec 11, 2011 on Blog

South Florida real estate finally made a good list!

“We are seeing an increase of closing services for short sales, foreclosures and home buyers looking to leverage good opportunities in this market,” said Weston Title’s Roy Oppenheim, a real estate attorney and legal blogger.

Experts seem to agree!

Despite national and global headwinds, Florida’s real estate market is entering 2012 on an upward trend, according to three leading U.S. economists.

This week U.S. economists gathered at the state’s 2012 Real Estate and Economic Conference in Orlando with some positive outlooks.

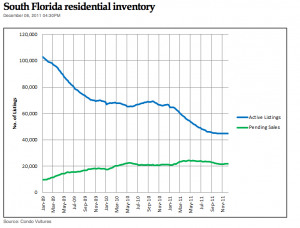

“Our state is in a mini-recovery,” said Florida Realtors Chief Economist Dr. John Tuccillo. “Sales are trending up, listing inventories are falling, the supply of lender-related properties has stabilized, and we are seeing multiple offers on homes in some local markets.”

Mark Vitner, senior economist at Wells Fargo in Charlotte, N.C., said the U.S. economy will continue to face significant challenges, particularly financial concerns related to the European debt crisis. But he expects the U.S. economic recovery will continue next year, making it easier for Midwesterners, for example, to buy Florida homes.

“Florida’s economy is recovering, with tourism and healthcare leading the way,” Vitner said. “On a national level, we expect the U.S. will not fall into recession next year, although Europe faces serious problems.”

Dr. Lawrence Yun, chief economist for the National Association of Realtors, said many Florida markets are showing sharp drops in inventories of homes for sale, a sign that demand is picking up and prices are stabilizing.

“That’s a major change from just a year ago,” he said. “Buyers have stepped back into the Florida market.”

Noting the state’s powerful appeal to international buyers, Yun said he was particularly optimistic about the outlook for South Florida. “Don’t be surprised to see a gain in home prices in the Miami and Naples markets in the next 18 months,” he said. “From there, the recovery is likely to roll northward to Central Florida and then North Florida.”

Portions of this article contributed by The Log by Florida Realtors.