Thinking of financing or refinancing your home? Here are some things to consider

Tue Jun 25, 2013 on Blog

The following blog has been written for Weston Title and Escrow.

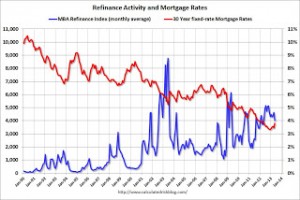

As interest rates trend higher, the Mortgage Bankers Association has seen a decline in the number of people filing for new mortgage applications, as well as for financing or refinancing your home.

The Federal Reserve, which has held mortgage rates at near-record lows for some time now, has helped to lift the housing market. However, during a speech in June, Chairman Ben Bernanke, gave clear signals that the Fed will start to pull back its stimulus by the end of this year, which could lead to a rise in interest rates.

If you have been sitting on the fence, unsure about whether to jump into the housing market, now might be the time to take the plunge, before interest rates climb any higher.

However, before you do, it’s important to understand the different types of loans available and their pros and cons.

Fixed-interest mortgage: As the name suggests, the interest rate on this mortgage remains the same for the life of the loan. Terms generally are for 10, 15 or 30 years and the payments are made in monthly installments over the life of the loan.

At the start of the loan, a small portion of the payment goes toward the principal – in other words, the cost of the home itself – while the rest goes toward interest. The longer you pay, the more money will go toward the principal. The shorter the loan term, the more money is paid upfront and the less toward interest. The upside is that you will always know what the interest rate is. The downside is that if interest rates go down, you will be stuck with a higher rate, unless you refinance. (More on that later).

Adjustable-rate mortgages: These are loans for which the interest rate varies. Most adjustable rate mortgage rates are tied to an index of financial securities that changes as the market changes.

The benefit of these mortgages is that initial interest rate is normally lower than the conventional rate, so you don’t have to pay as much at the beginning of the loan. The downside, and what many homeowners learned as the economy began to falter, is that these rates can, and will go up, often leaving the homeowner unable to keep up with the payments.

If you already have a mortgage and you are thinking of refinancing, do your homework. Get a copy of your credit report. You can access it once a year at no cost. Make sure there are no blemishes on that report because it can muck up your chances to refinance. Those low interest rates you may see advertised generally are reserved for those with the best credit scores.

Make sure you have a good understanding of the costs associated with a refi. What many folks don’t think about are the refinancing fees, the origination fees and the points. They all add up.

Check to see if you have a pre-payment penalty on your existing loan, or if you have been in your home long enough so that the savings outweigh the costs. Also, think about how long you plan to stay in the house after you refinance. If you don’t plan to stay longer than five years then it may not be worth the time, money and paperwork.

The bottom line: Many are predicting that the nascent housing recovery is beginning to gain momentum. Once the fed starts to increase interest rates it usually doesn’t stop until there is an outside event that rocks the economy off its hinges.

The information in this article is for general informational purposes only. It is not intended as professional counsel and should not be used as such. You should contact an attorney to obtain advice with respect to any particular issue or problem. Weston Title & Escrow is a trusted Florida title company. Providing Florida real estate closings, title insurance, title searches, and escrow services since 1994, Weston Title is owned by real estate attorneys Roy Oppenheim and Ellen Pilelsky, the founding partners of Oppenheim Law.