The Search for Affordable Homes

Wed Sep 8, 2021 on Blog

Many prospective homebuyers are waiting for a correction in the housing market to purchase a home at a bargain comparable to the 2008 market crash. However, there are different factors now. The housing bubble 15 years ago was largely driven by questionable lending policies that led to a boom in new construction and a speculative frenzy. Now, prices are high as before, but low interest rates and lack of supply due to the difficulty in part of getting supplies are an issue as well as less inventory due to the lingering impact of the COVID crisis.

Where Is the Intense Housing Demand Coming From?

The demographics of homeowners looking to purchase a home today include people who are relocating from the Northeast and the West Coast for tax reasons, millennials wishing to purchase their first homes, and people seeking more space as remote work continues.

How Is the Real Estate Market of 2008 Different from Now?

Unlike the Great Recession, today’s lending practices are more stringent, requiring homeowners to have a bigger down payment when purchasing a home. According to David Druey, Centennial Bank Florida Regional President, “During the Great Recession, we had mortgage companies and banks financing 100 percent of the purchase price and closing costs. We created our own crisis.”

Aside from stricter lending policies, 60 percent of homebuyers who finance with a mortgage said that low interest rates played a role in their decision to purchase a home. According to Bankrate.com, rates for a 30-year fixed mortgage stand at 3.03 percent while rates for a fixed 15 years are 2.03, as of September 1, 2021.

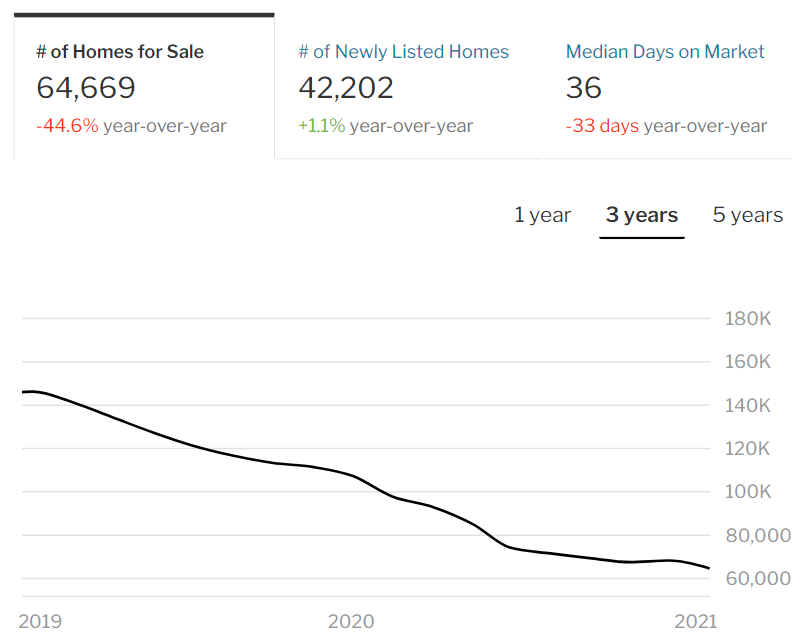

Additionally, the number of homes on the market now is dramatically different. In 2008, there was an oversupply; now, the number of homes listed have significantly decreased. Listings for homes plunged 61 percent in Palm Beach County compared to 4 years ago; Broward County listings decreased 46 percent, while in Miami-Dade was similar at 39 percent.

While home prices in 2021 are higher than in previous years, they have not reached the height of home prices during the 2008 crash. During that period, homes were overvalued by almost 60 percent; now, homes in south Florida are overvalued by about 13 percent.

What May We Expect?

Source: Redfin

Some economists claim that the shortages of homes for sale coupled with low interest rates and relocations to south Florida from out-of-state residents should keep us from sustaining a housing crisis that led to the Great Recession of 2008. While experts believe a correction in home prices may not happen until sometime next year, changes in the economy will inevitably affect the housing market.

While there is no magic ball to accurately predict the future, we had indicated in an earlier blog that we all may agree that the frenzied housing market is nearing heights that are reminiscent of the mid-2000s. Aside from low interest rates, supply shortage, and demographic shifts, we all recognize that the pandemic has added a layer of complexity to the mix, and the inevitable likely end of the eviction and foreclosure moratoria adds more challenges to the housing market.

Should you have any questions or need assistance with a residential real estate purchase or sale, our title company, Weston Title & Escrow, Inc. is able to help you and can be reached at 954-384-6168. Should you have any legal questions about a potential purchase or sale or another legal matter, our team at Oppenheim Law can be reached at 954-384-6114.

Roy Oppenheim

From The Trenches

Originally posted at: https://southfloridalawblog.com/the-search-for-affordable-homes/