Rent Control and the South Florida Estate Market

Thu Feb 24, 2022 on Florida Real Estate

As rents continue to escalate, many renters are being forced to move. Rents in West Palm Beach, Fort Lauderdale, and Miami have increased a little over 34% last year, leaving some people sleeping in their cars. This is at a time when inflation continues to escalate with prices rising 7.5% in January compared to last year, the largest increase since February 1982 according to the Consumer Price Index. The question becomes: Can rent control be an option here?

In order to place rent control in Florida, municipalities must determine that there is a housing emergency. In Broward County, for example, local leaders would have to vote in favor of rent control and then defend their position should a landlord challenge the vote. Orlando Commissioners had, in June 2020, prepared a report that demonstrated housing costs in the area and the effect on the rental market, finding that there was a housing emergency—yet, local Orlando leaders at that time did not even have the votes to hold a hearing on the issue.

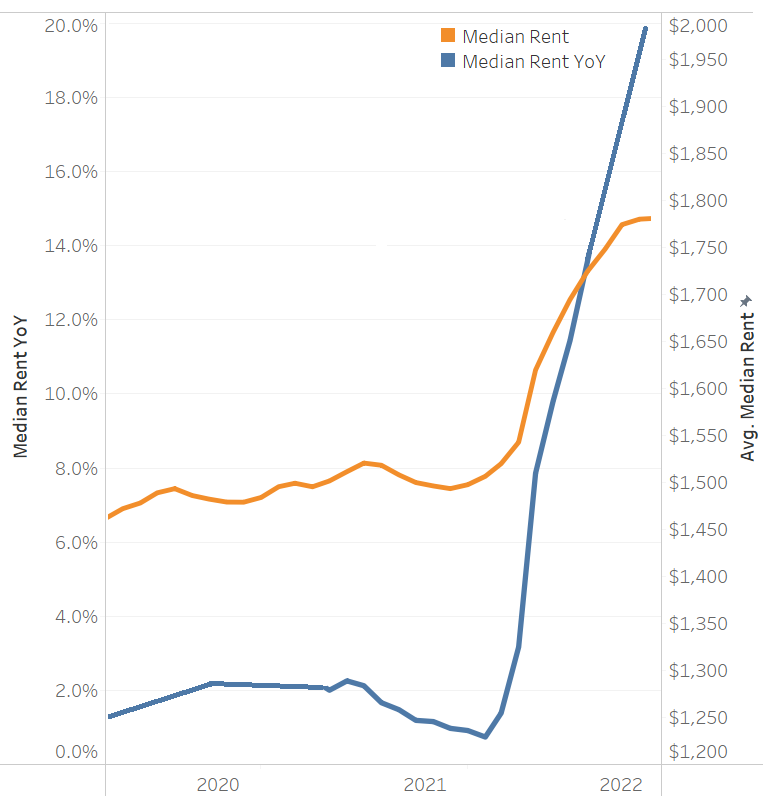

South Florida Rent Prices Picture Courtesy Realtor.com

Unlike Orlando, Miami Beach had, in 1974, a successful rent control campaign where city leaders found that the housing situation at that time was dire enough to require regulation. That rent control ordinance lasted eighteen months.

Other states, such as New York, Oregon, and California, have rent control laws in place. In New York, for example, city law governs the percentage amount an owner/landlord can raise prices. California has a rent control law that prohibits rent increases of more than 10% or by 5% plus the increase in cost of living, whichever is less, until the law expires in 2030. Oregon caps rent increases at 7% plus inflation on multifamily buildings built over fifteen years ago.

Prices in the South Florida rental market continues to rise. The average rent in Miami-Dade County for an apartment is $1,931, in Fort Lauderdale $2,357, Pembroke Pines $2,375, and West Palm Beach is $1,909. Respectively, the overall percentages of increases from last year are 52.4% in South Florida.

Picture Courtesy CBS News Miami

How did this happen?

One factor in the astronomical rent hikes is that landlords negotiated with lower prices during the onset of the pandemic. Now, as more and more people are headed to South Florida with limited housing inventory, the same landlords are able to raise rents and even obtain multiple offers for the same apartment. Other landlords have experienced rising property taxes and home insurance costs which inevitably cause higher rates for renters.

How may rent control effect the Housing Shortage?

Rent control does not completely address our exacerbating housing shortage. For some landlords and developers, rent control does not address rising property costs, including insurance taxes, and maintenance costs, or the lack of land to build on. There is also a concern about how rent control may dissuade investors from investing in real estate projects, further effecting the housing shortage supply. Additionally, rent control may affect smaller landlords, who operate on thin margins, by putting them out of business and forcing them to sell their properties.

What does this all mean?

Regardless of the “how’s” and “why’s”, the issue remains that it is becoming more and more difficult to find affordable housing in South Florida. There are not many protections for renters to currently cap the amount rent increases, as Florida simply does not have rent control laws capping how much a landlord can raise rent. With rising inflation and an influx of people relocating to South Florida for the lifestyle and attractive tax benefits, there is tremendous pressure on our housing market. The ever growing demand and lack of supply for affordable housing coupled with rising inflation signal that change is inevitable.

Stay tuned!

Roy Oppenheim

From The Trenches