Climate Change, The Consumer Price Index, and Homeowner Insurance

Thu Apr 11, 2024 on Blog, Florida Real Estate & News

The US Consumer Price Index, a key metric of inflation, does not include the rising price of homeowner insurance. According to Bloomberg Intelligence, increased homeowners’ insurance would have added 80 basis points or approximately .8% to the reported CPI increase of 3.4%, meaning inflation would be more like 4.6 %.

By not including home insurance, the CPI does not factor in climate costs. Homeowner insurance costs of $175 billion in the US was up 21% over the previous year. Why? The increase is largely due to climate change which has caused more extreme fires, floods, and storms. The U.S. had a record 28 weather and climate disasters that each caused more than $1 billion in damage last year. As insurers incur higher costs, homeowners face higher premiums. As a result, the average cost of insurance a U.S. home last year was $1,905.00, up 50% from the average of $1,272.00 in 2019. The cost of homeowner insurance premiums is predicted to hit a potential record of $2,552 by the end of 2025 due to weather disasters, increased reinsurance rates, and high home repair fees.

What does CPI measure?

The CPI measures the average change in prices paid by urban consumers for various goods and services including food and fuel. CPI includes the category of “tenants and household insurance,” but this is more known as renters’ insurance.

The average renter’s insurance in the US was $180, up 3% from last year. While homeowner insurance costs have surged, renters’ insurance has generally held steady since it does not include the kinds of structural damage caused by extreme weather events. Yet, the CPI does not include the effect of homeowners insurance on the economy.

How does the CPI affect inflation and interest rates?

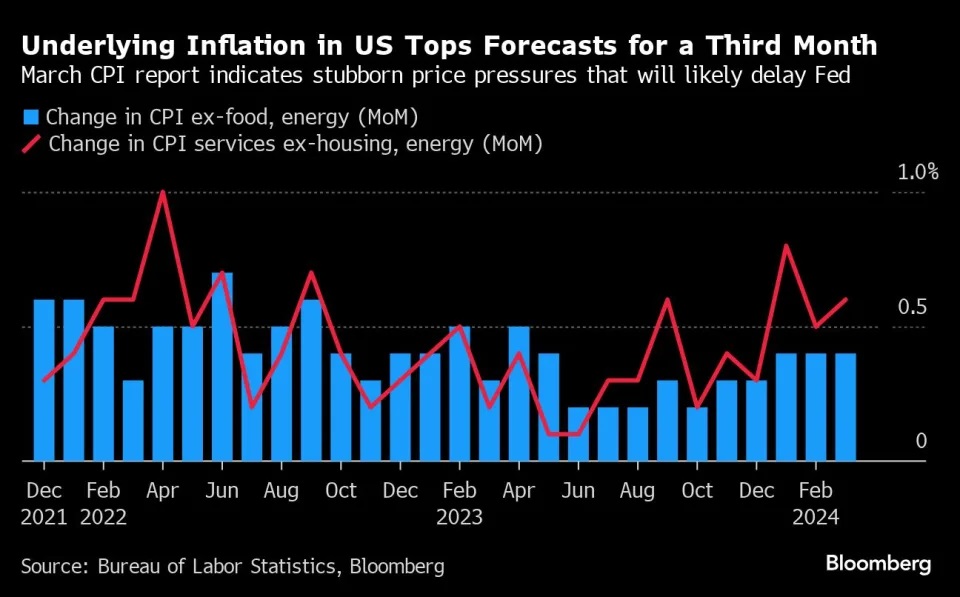

Since inflation is still high as reflected in the 3.5% rise this March as compared to last year, the Federal Reserve will likely keep interest rates as is. As a result, the real estate market will continue to soften until such time as interest rates start to decline.

What does this all mean?

Aside from cash buyers, the residential real estate market has been undergoing a lock-down effect. Simply put, homeowners are not willing to sell their homes because they effectively have nowhere to go and feel “locked-in”. Their current mortgage payments may be less than potential mortgage rates for a new house. Thus, a seller may simply stay put because a new home payment would most likely exceed what they are currently paying. The real estate market is continuing to evolve given the current economic climate.

From the trenches,

Roy Oppenheim

Originally posted at: https://www.oppenheimlaw.com/news-resources/climate-change-the-consumer-price-index-and-homeowner-insurance/