Why is there a Housing Market Slowdown?

Tue Aug 23, 2022 on Florida Real Estate

OVERVIEW:

- Why the housing marketed has been hot in 2022

- What suggests prices are starting to cool down

- How homes prices will affect the economy

For the sixth straight month, the number of U.S. home sales have decreased, the longest decline in more than eight years. Higher mortgage rates and purchase prices are just two overall reasons for this drop. According to the National Association of Realtors (“NAR”), sales of previously owned homes dipped 5.9% in July from the previous month, down 20.2% from a year ago.

The housing market slowdown illustrates that the booming housing market which began during the onset of the pandemic is waning. During the middle of 2020 at the height of the pandemic, demand for larger home space as well as relocations away from urban areas due to remote working surged while mortgage rates were at record lows.

Now, however, sales are slowing, and purchase prices, while still high, are starting to ease. According the NAR, the median price of an existing home fell from $413,000 in June to $403,800 –the first decline since January. Some economists believe that there will be further price reductions as demand decreases by year-end. Yet, in Miami and Tampa experienced higher home prices actually rose 9.4% over last year, well over the national rate of 8.5%.

The South has the fastest inflation

Even though Northeastern inflation has been moderate, Atlanta, Tampa, and Miami are seeing rapid price increases.

One reason why South Florida, particularly Miami and Tampa, have higher than national home prices is because of inflation. Fuel and electricity costs have surged, and our geographic location is reliant upon both. Simply put, we are dependent upon cars and air conditioning. Rental housing, just as in 2008, plays a critical role and this time, the South Florida rental market is a major contributor to inflation. Rents in Miami, for instance, are up approximately 14% from a year ago where for urban dwellers nationally rent is up only about 6.3%.

Further, as more people relocate to Florida from other states, particularly California and New York, in order to take advantage of the favorable tax climate and weather, there is an increased demand for local services, whether it is day care, food, or housing. This in turn increases the price of goods since supply is lessened. Further, when people come to Florida for second homes, the housing supply lessens which, in turn, causes prices to climb.

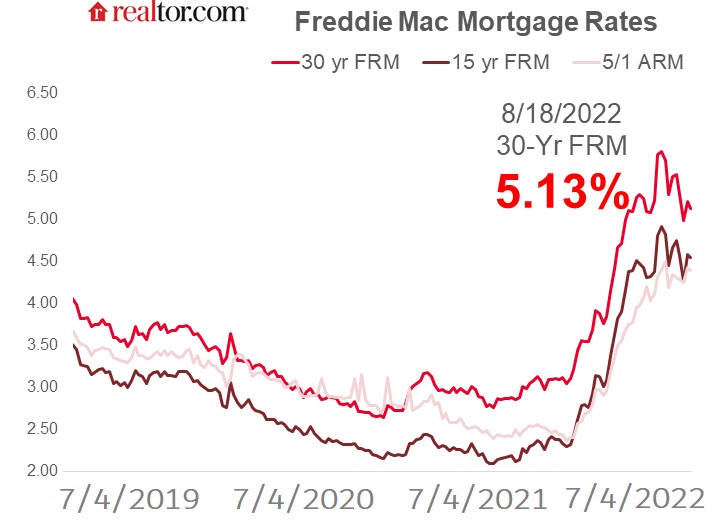

While the Federal Reserve has been raising interest rates to combat inflation, mortgage rates have risen as well. According to Freddie Mac, the average 30-year mortgage rate is at 5.13%, which is still above the 2.86% rate from a year ago. The last time mortgage rates were more that 5% was in 2011.

Another reason why the market is slowing is that home affordability is at its lowest level in decades. Eric Yun, the chief economist of NAR, claims that home buyers now will pay 25% of their income, up from 15% before the pandemic. Part of the reason for this is that, while more sellers are placing homes on the market, there, again, is still not enough homes for sale. price.

Finally, household incomes have not kept pace with inflation and to purchase a median priced home in Miami today is $515,000, requiring a household income of approximately $158,000.00.

What does this all mean?

The housing market is the process of a correction. Inflation, migration, housing affordability, and supply all are factors. The South Florida market at some point will equalize with the rest of the country and foreclosures and distress sales will ultimately help re-equalize the market.

Stay tuned!

Roy Oppenheim

From The Trenches

originally posted at: https://southfloridalawblog.com/why-is-there-a-housing-market-slowdown/