Theft by Title Fraud

Mon Aug 29, 2022 on Florida Real Estate

Real Estate deed fraud unfortunately is on the rise. Recently, the Sun Sentinel reported that a property owner’s vacant land was sold by a person who pretended that he was the actual landowner in order to obtain the proceeds of a fraudulent mortgage refinancing. Initially, the alleged fraudster created a company using his name as the owner of the property and later created yet another company, using the rightful property owner’s name, with a driver’s license with the true owner’s name but with his own photo. A remote notary requested the alleged fraudster’s fingerprint which later was identified to not be the rightful owner of the property. The actual owner found about the sale of the property by receiving mail addressed to the fraudster’s company at their address, learning that a deed and mortgage had been recorded on their land. Subsequently, the alleged perpetrator has been indicted by a federal grand jury.

This situation leads to a myriad of questions as to curtailing such fraud, and the role of each party in the closing process. In this case, the alleged fraudster claimed initially to be the owner of the property using his true identity which should have been a red flag.

How can you protect against title fraud?

Fraudsters typically have been known to target properties that are vacant or vacation houses, and/or monitor death certificates in order to target properties where surviving family members live out of state.

While you can monitor your property by searching your name within your county’s property appraiser’s office website, you can, depending upon your county, sign up for a free service that will alert you should anything affecting your title be recorded. Typically, new homeowners receive a substantial amount of junk mail after purchasing a home. If you start to receive this kind of mail and have not recently purchased a home, you may want to check the public records.

While there are services in which you can also pay to monitor your deed, perhaps the most important tool is for title professionals…notaries, mortgage brokers, real estate agents, lenders, and title companies… to be extremely attentive to all details of the real estate transaction. The mere fact that the alleged fraudster in the recent deed theft used his own name as the owner of the property should have been a huge tip off from the get-go that something was amiss.

Is Title Insurance a Commodity?

The ever-changing real estate market poses challenges to the overall title industry. Technology has both allowed real estate transactions to become more efficient, and yet also has, brought on bad actors who use technology to create fraudulent documents.

Title insurance is important for piece of mind because as the owner or seller of property or the lender, the ensuring and insuring of the conveyance of title is paramount. Title insurance is not a commodity because it really depends upon the level of service and attention to detail the title company provides. In the situation at hand, the lender who advanced the loan proceeds will file a title insurance claim and receive back its money without the need of foreclosing on the innocent owner’s property. However, other title companies may have caught onto the scheme earlier and never allowed the alleged fraudster to get away with his felonious act.

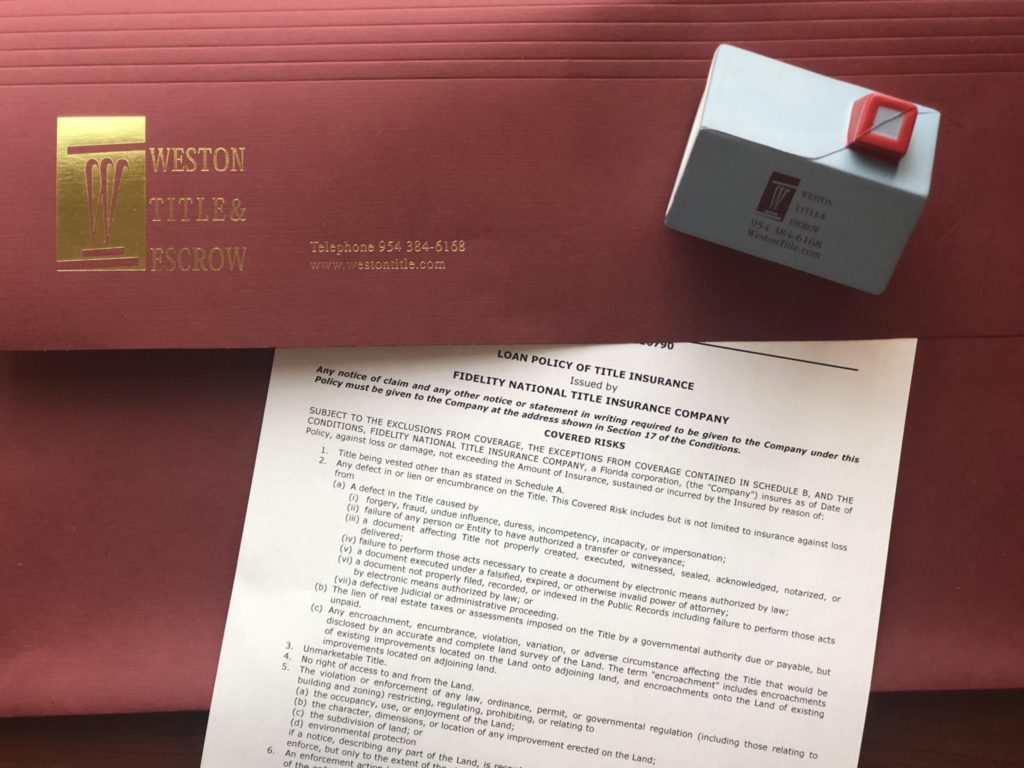

For over 31 years, our team at Weston Title has served our community with the utmost care and precision to detail. Should you be buying, selling, refinancing your property, or you are a professional investor or lender, feel free to contact us at 954-384-6168.

Roy Oppenheim

From The Trenches