The Effects of the South Florida Housing Slowdown

Tue Sep 20, 2022 on Florida Real Estate

OVERVIEW:

- Market effects of real estate

- Overproduction

- Purchasing less consumer goods

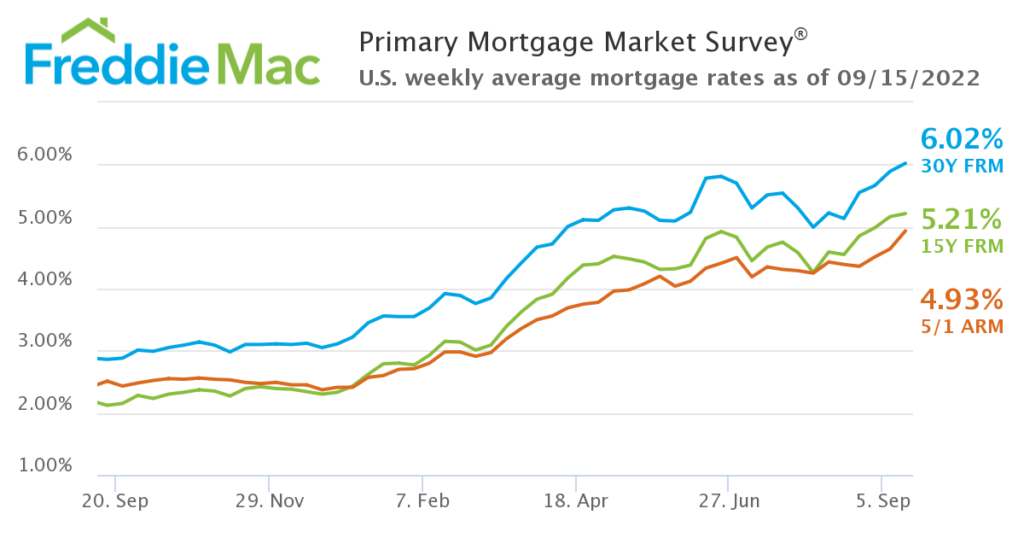

With mortgage rates surging past 6% this week, the cost of home ownership is becoming more out of reach for borrowers. Some borrowers are deciding to wait, hoping that prices and rates will fall as the overall market and inflation slows with it. Other home buyers, however, are opting for adjustable-rate mortgages, buying homes for lower payments now, and eventually refinancing when rates are better.

The average rate of a five-year adjustable-rate mortgage is 4.93% this week as opposed to the 6.02% average rate for a 30-year fixed loan, according to Freddie Mac. This time last year, mortgage rates were as low as 2.86%. Increased rates mean bigger monthly payments for home buyers. A monthly payment on a $300,000 30 year fixed home mortgage is $1,250 at 3% and about $1,800 at 6%—a 44% increase. As a result, many home buyers have to pay nearly $600 a month more for the same home if they choose a fixed mortgage.

Rising mortgage rates are only one factor slowing the real estate market. Other factors include low supply and high prices. As a result, housing affordability is at the lowest level since 1989 which, in turn, is indicative of the slowing South Florida housing market.

How does the real estate market effect the overall market?

Overproduction

Picture courtesy News Supply

There are so many effects of a housing market in flux. As more home buyers wait for either rates or pricing to decrease, the uncertainty has flowed into the greater market. How? More businesses overproduced in order to satiate the frenetic housing market during the past two years. These businesses, dependent upon home sales, include furniture manufacturers, home builders, interior designers, architects, appraisers, and the overall construction industry.

A recent article in the Wall Street Journal reported that Scotts Miracle-Gro, for instance, has gone from trying to supply consumers’ high demand for lawn seed, fertilizer, and other garden products for the past two years. During the outset of the pandemic and over the past year or so, most people were spending more time at home, doing home improvements. Scotts Miracle Gro could not keep up with the demand, so decided to ramp up production. However, with inflation and the housing market cooling, Scotts Miracle Gro overproduced and is now faced with huge lay-offs, and losses.

Bottom line is that consumer spending has shifted once again as the pandemic has eased and the economy has changed. The overall economy relies upon the housing market. As a result, with a slow-down in South Florida real estate due to mortgage rates and inflation, businesses that provide goods for homes are winding up with bloated inventory and/or huge losses.

What does this all mean?

As we have stated previously, the housing market is the process of a correction. Other industries that contribute to the overall real estate market are affected as well. With a housing slow-down, less consumer goods are being purchased, and less consumer demand for services are occurring and with that just maybe we will begin to see an unwinding process that will bring down inflation.

Stay tuned!

Roy Oppenheim

From The Trenches

originally posted at: https://southfloridalawblog.com/why-is-there-a-housing-market-slowdown/